Rent vs. Ownership in the UAE: It’s Not as Obvious as You Think

Why This Matters in the UAE

The majority of residents in the UAE rent. Yet, conversations about homeownership, whether over dinner or coffee, often carry an aspirational tone, tinged with the pressure to eventually buy. Ownership is often framed as the smarter financial choice, with renting dismissed as “throwing money away.” But is that assumption always true?

Renting: Simpler but Misunderstood

Renting offers simplicity. You pay a predictable monthly amount, avoid large upfront costs, and aren’t responsible for maintenance or fluctuating interest rates. In a fast-moving, expat-heavy market like the UAE, that kind of flexibility has real value, financially and logistically.

Ownership: More Than the Mortgage

Homeownership, comes with layers beyond the monthly mortgage. Buyers need to consider maintenance, service charges, insurance, and hidden costs like transfer fees and agent commissions.

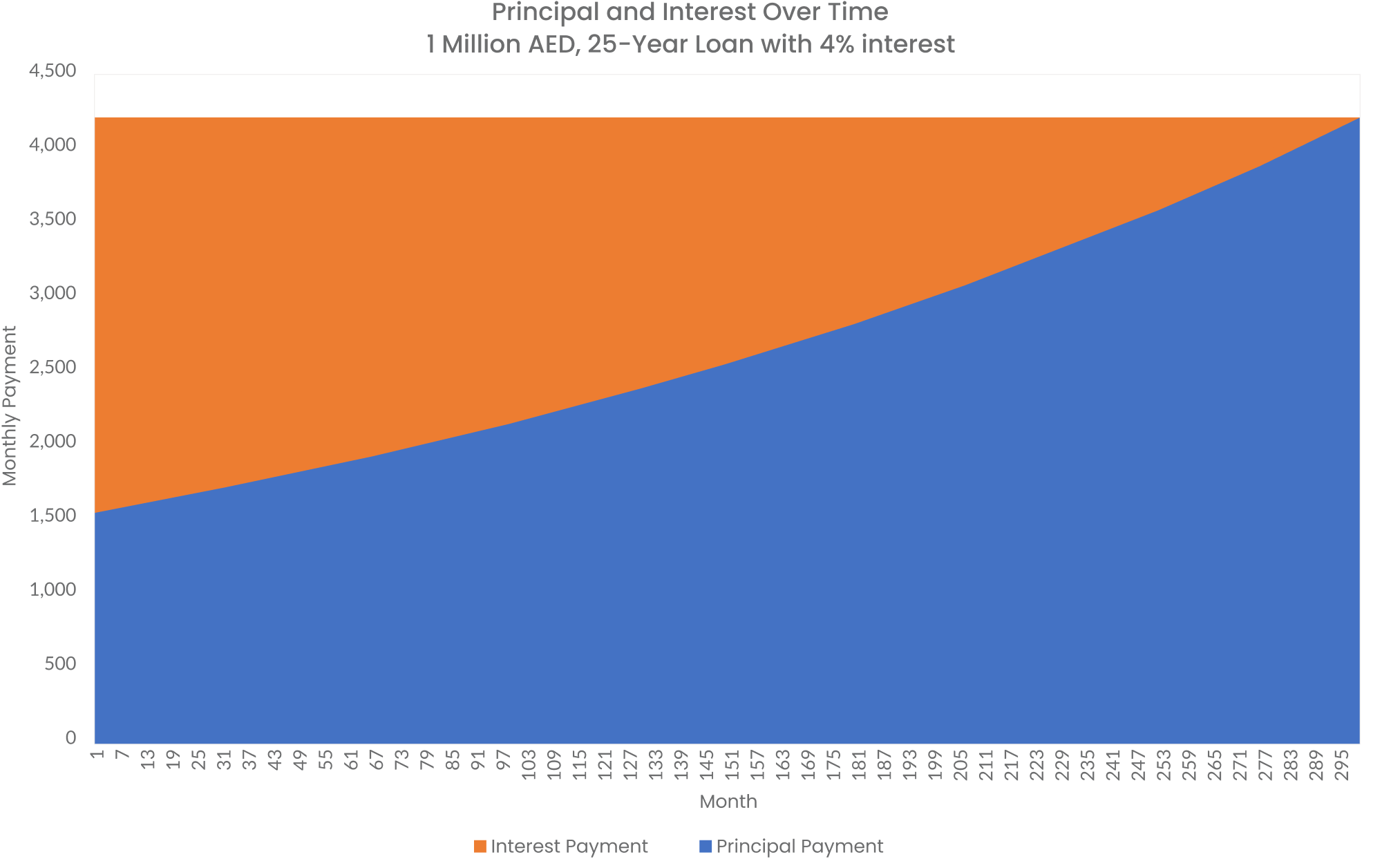

Crucially, as with most mortgages, interest is front-loaded - meaning that in the first 5–7 years, you’re paying mostly interest, not building equity. The chart below shows how most of your early monthly payments go toward interest rather than the principal.

Off-Plan: The Cash Flow Angle

Off-plan purchases introduce a different dynamic. With flexible post-handover payment plans and lower upfront costs, many buyers treat off-plan more like a savings plan than a traditional purchase.

And since post-handover payments can often be mortgaged, the fear of a full AED 2 million price tag should be viewed in monthly cash flow terms, and even more only a portion of that is spent as 30/70, 40/60 plans rather than a lump sum shock.

The Real Question: What Works for You?

For some, owning brings stability, emotional satisfaction, or a sense of permanence. For others, renting allows freedom, mobility, and access to locations they might not afford to buy in.

The point isn't that one is better than the other - it’s that neither is inherently better. It depends on how long you plan to stay, how disciplined you are with your money, and whether your lifestyle fits one model better than the other.

There’s no universal answer. But by understanding the full picture - interest amortization, opportunity cost, cash flow flexibility, and lifestyle goals - you can make a better decision.

In a market like the UAE, where flexibility is high and financial products are evolving, the rent vs own debate is less about right or wrong - and all about what fits your lifestyle.